The Uncommon Business Bulletin #2

Our roundup of relevant news, links, and resources for small and medium sized businesses, leaders, employees, entrepreneurs, and curious humans.

The Uncommon Business Bulletin is a regular roundup of news, articles, and other things that (we hope!) are relevant to small- and medium-sized business, entrepreneurs, leaders, employees, and readers who are generally interested in entrepreneurship, leadership, economics, policy, and finance.

The Uncommon Business Bulletin #2

August 2nd, 2024

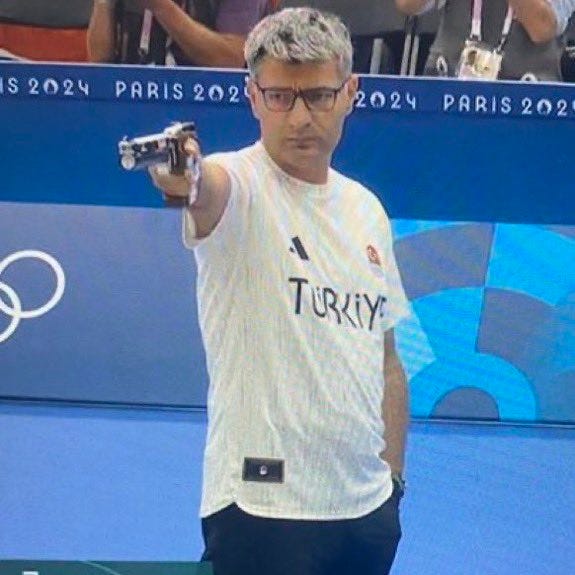

Is there any internal operations activity that your company does exceptionally well that you could turn into a product or service to sell to other businesses? That’s what Kyle Koehler (no relation to me, Peter Koehler), CEO of Wildway Foods, has done with his business (for the unfamiliar, 3PL = Third Party Logistics):

Kyle’s original post is here. Kyle runs a great mission-driven food business (Wildway Foods) and he is a great follow on LinkedIn. As you think about your 2025 Strategic Plan (btw, if you need help with that process, reach out to us), consider whether there are any natural/organic ways to diversify your revenue by capitalizing on your existing strengths.

The SBA has a couple of new/expanded loan programs small business owners and managers should be aware of:

They are expanding a flagship lending program to favor more climate-friendly businesses. Per The SMB Center: “This includes businesses involved in renewable energy, energy efficiency, and other climate-friendly projects….The expanded loan program offers several advantages for green startups. These include competitive interest rates, extended repayment terms, and the ability to use the funds for various purposes such as working capital, equipment purchase, and refinancing existing debt.”

They are introducing a Small Business Line of Credit Pilot Program later this year. It will create “a government-backed credit line designed to give [small businesses] greater flexibility than a traditional term loan.”

Should you hire more former freelancers? Jason Fried, CEO of Basecamp, thinks so. In his appearance on The Uncommon Business podcast, Jason talked about how thinks about hiring, and why he loves hiring former freelancers (one core reason: They are better at self-management). Listen to the full episode (or on Spotify / the pod player of your choice)

“Patagonia is the exception, not the rule. Most of the businesses making this transition to trust ownership are small or medium sized businesses.” Recently I (Peter) was on a The 21 Hats podcast to talk about Employee Ownership Trusts as a succession planning option for mission-driven business owners. If you own a small business and you are thinking you want to retire or move onto your next thing sometime in the next five years, you might find this episode useful and informative. If you are interested in exploring Trust Ownership for your business, reach out to us by sending a note to hello@lumogroup.co. We can help.

Are you a small-business owner who doesn't have any employees (apart from you and your spouse)? If so, then a Solo 401k (also known as a Self-employed 401k or an Individual 401k) is likely the best plan for you in terms of being able to maximize your contributions.

If you’ve been dragging your feet on setting up your own retirement plan, or if your enrolled in another plan type (like a SEP IRA) and feel like you want to increase your contributions, it could be worth looking into a Solo401k.

Here is a good overview from Fidelity and here is a helpful Twitter thread to give you a quick 101 on Solo 401Ks and their benefits.

One decision to make is whether you want to use a standard 401k or a Roth 401k. Personally, since you can’t predict future tax rates, I like to optimize for tax diversification, and I split my contributions 50/50 between standard and Roth. This is a geeky finance nerd thing to do and it will likely have a marginal impact, if any. So don’t stress about picking the “right one.”

Not all providers offer Roth Solo 401ks though, so if that is important to you, then you will need to find one that does, such as ETRADE, Schwab, or Vanguard.

If you want access to a wider variety of investment options (i.e. real estate, crypto, private company stock), then you will want to open a self-directed 401k. There are multiple providers of those, such as mysolo401k.com.

KYM: Know Your Memes:

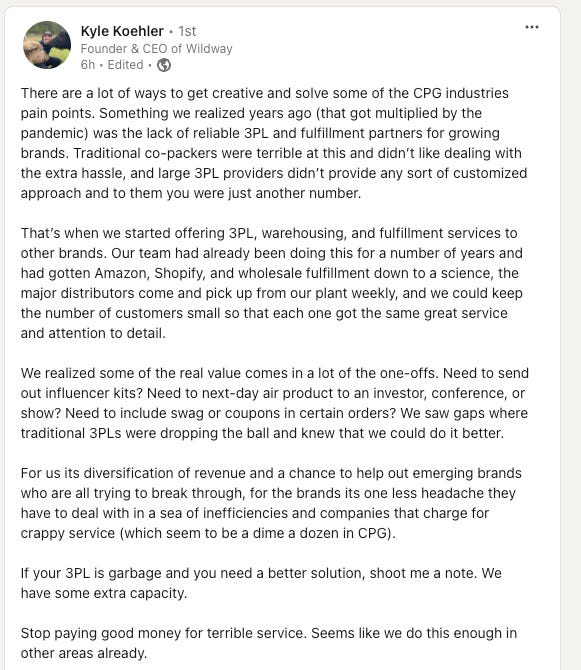

This week two Olympic shooters took the internet by storm: Kim Yeji of South Korea and Yusuf Dikec of Turkey (photos below). The images speak for themselves: Yeji looks like hero/villain from a movie set in 2075 (“the most aura I have ever seen in an image” says the X account Women Posting Ws). Dikec, 51, looks like your local accountant who walked in off the street (note the lack of specialized lenses or ear protection and the hand in the pocket). They both took home silver medals.

That’s all for today folks.

Enjoy your weekends. Life is beautiful. Do good work. Etc.

Reply to this email and let us know what you thought.

Oh, and one specific question for you:

What day of the week would you prefer that we send these out?